does maine tax retirement pensions

As a member of. For the other pension income you get a maximum exclusion of 10000 eachBUT that 10000 maximum.

New Retirement Savings Law Will Benefit Maine Workers And Taxpayers

Arizonas exemption is even lower 2500.

. Military retirement pay exempt. Also your retirement distributions will be subject to state income tax. Deduct up to 10000 of pension and annuity income.

Maine allows for a deduction of up to 10000 per year on pension income. MA pensions qualify for the pension exemption. Compared to other states maine has relatively punitive tax rules for retirees.

51 rows In addition for Louisiana individual income tax purposes retirement. So you can deduct that amount when calculating what you owe in taxes. In Montana only 4110 of income can be exempt and your adjusted federal gross income must be less than 34260 to even qualify.

In general Maine tax laws conform with the federal tax code. As our Maine retirement friendliness page will show you Maine is not the most tax-friendly state for retirees. MA pensions qualify for a pension exemption.

The state taxes income from retirement accounts and from. Your military retirement is fully exempt from Maine state income tax. Social Security is exempt from taxation in Maine but other forms of retirement income are not.

To enter the pension exclusion follow the steps below in the program. Retirees are able to exclude the first 5000 15000 if 55 and older of their military pension benefits. Am I eligible for the Maine Pension Income Deduction.

However that deduction is reduced in an amount equal to your annual Social Security benefit. Seniors who receive retirement income from a 401k IRA. According to the maine department of revenue military pension benefits including survivor benefits will be completely exempt from the state of maines income tax.

Residents of the Granite State pay no taxes on Social Security benefits pensions or distributions from their retirement plans because theres no general income tax. The state does not tax social security income and it also provides a 10000 deduction for retirement income. If you file State of Maine taxes you might be eligible for a deduction of 10000 as a single taxpayer or 20000 as a married.

However your Social Security benefits count toward this amount. Now that they are collecting social security the tax calculation requires an extra step. For tax years beginning on or after January 1 2016 the benefits received under a military retirement plan including survivor benefits are fully exempt from Maine income tax.

First the first 10000 of any retirement income taxed at the federal level will not be taxed within Maine. Reduced by social security received. Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states have no state.

The 10000 must be. All employees except certain appointed officials are required to join the Maine Public Employees Retirement System MainePERS. Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income.

Up to 6000 in other. Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states have no state. Is Maine tax-friendly for retirees.

Residents of the Granite State pay no taxes on Social Security benefits pensions or distributions from their. You will have to. For tax year 2004 the maximum exemption is 40200.

Is my retirement income taxable to Maine. According to the Maine Department of Revenue Military pension benefits including survivor benefits will be completely exempt from the State of Maines income tax.

Maine Retirement Tax Friendliness Smartasset

How Every State Taxes Differently In Retirement Cardinal Guide

How Every State Taxes Differently In Retirement Cardinal Guide

Maine Estate Tax Everything You Need To Know Smartasset

Maine Retirement Taxes And Economic Factors To Consider

Retiring These States Won T Tax Your Distributions Tax Defense Network

Taxation Of Social Security Benefits Mn House Research

States That Don T Tax Retirement Income Personal Capital

Tax Withholding For Pensions And Social Security Sensible Money

What Happens To Taxpayer Funded Pensions When Public Officials Are Convicted Of Crimes Reason Foundation

Benefit Payment And Tax Information Mainepers

Tax Withholding For Pensions And Social Security Sensible Money

Maine Retirement Tax Friendliness Smartasset

Maine Retirement Tax Friendliness Smartasset

How To Plan For Taxes In Retirement Goodlife Home Loans

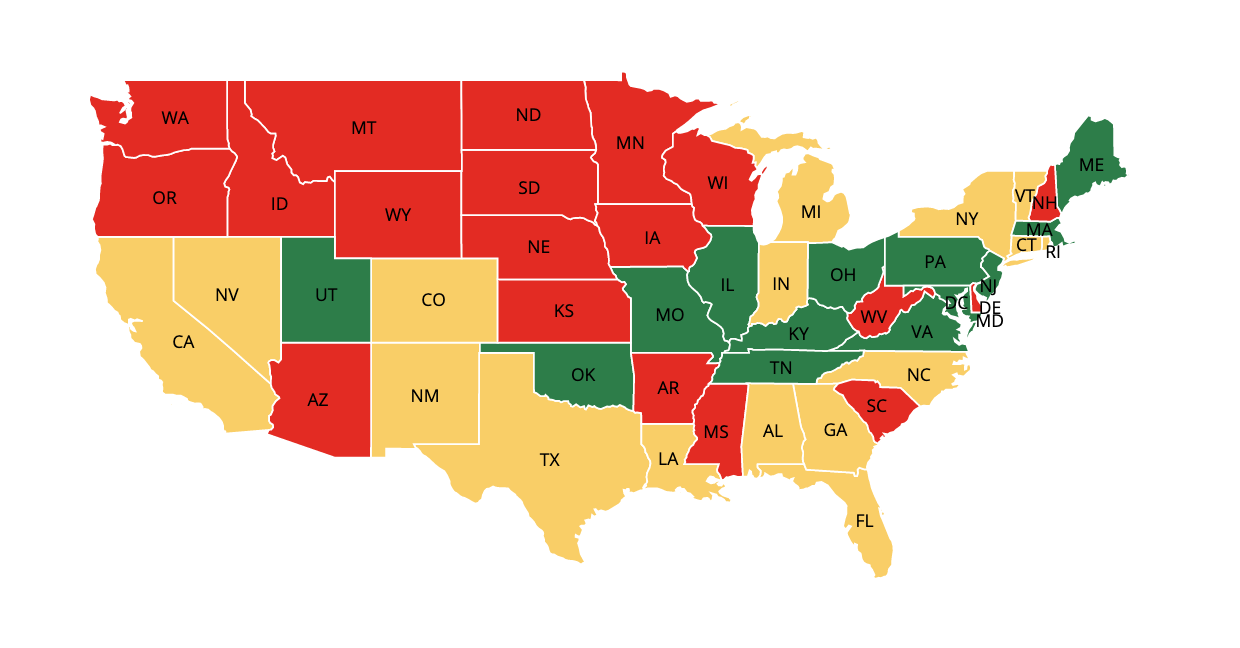

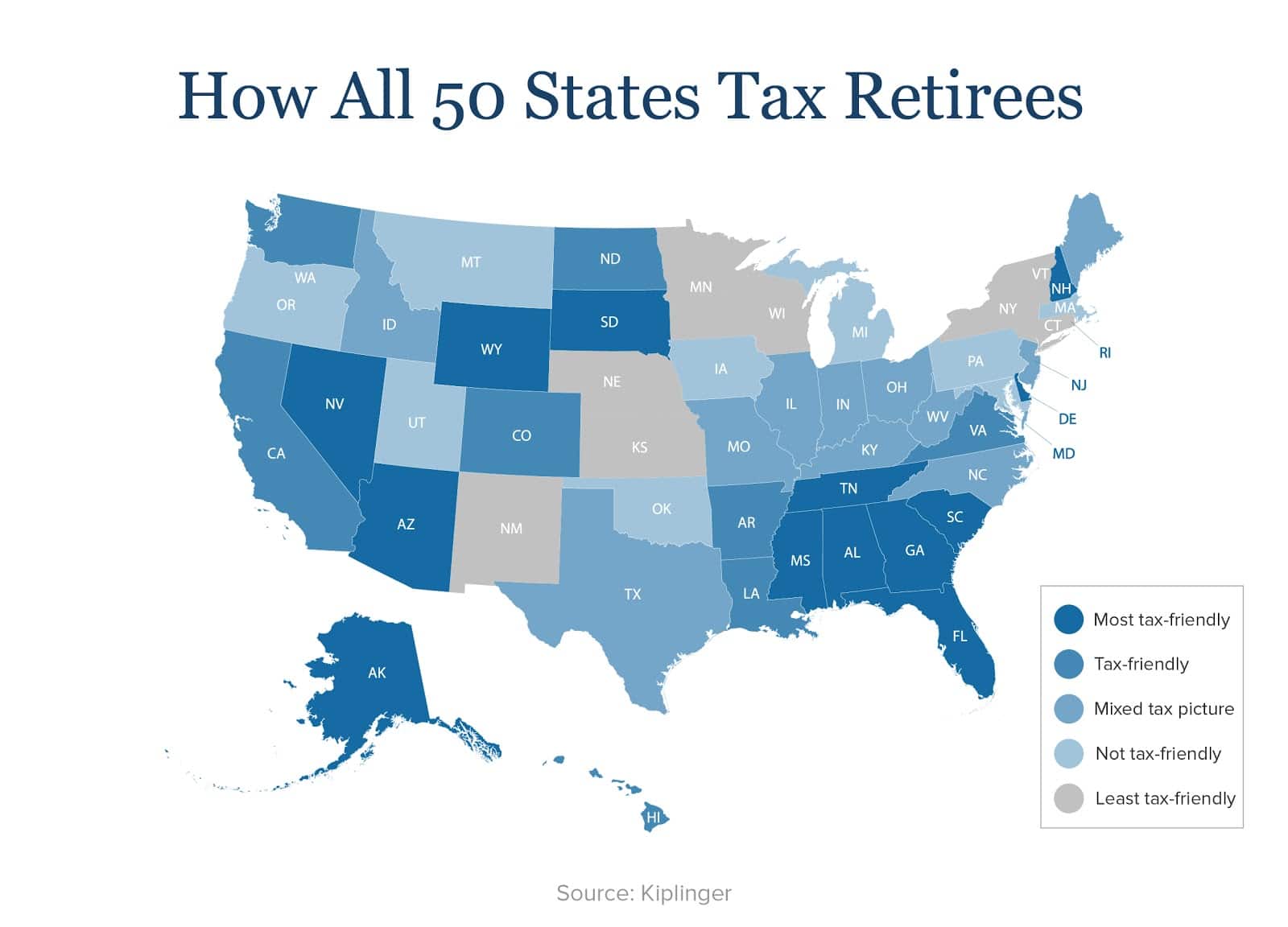

The Most Tax Friendly States For Retirees Vision Retirement